|

| Venture Capital Financing in Singapore |

If there is one thing that can lay a strong foundation to any

business, it is capital. Without capital, it is impossible to think about

establishing a company and earning revenues. For entrepreneurs who are wandering

in search of suitable investors for their startups, Singapore has emerged as a

great destination. The industry of venture capital financing in Singapore is

increasingly getting developed owing to the large number of venture capitalist entering

the sector every year.

Today, there are numerous local and international venture

capital firms located in Singapore that are looking for opportunities to pour

their money on unique business ideas. Some are government-backed while some are

private and together these firms have given a significant boost to the startup

industry in Singapore.

Here’s a list of some of the most prominent VC firms that are

ready to offer immense support to high-potential startups seeking venture

capital financing in Singapore.

List Of Firms

Offering Venture Capital Financing In Singapore

Ardent Capital

- Industry Preference – Technology with focus transactional commerce and advertising businesses.

- Stage Preference – Early stage investments.

- Industry Preference – Technology with focus transactional commerce and advertising businesses.

- Stage Preference – Early stage investments.

Adams Street Partners

- Industry Preference – Software, enterprise software, biotechnology, etc.

- Stage Preference – Seed stage, early stage, later stage and private equity investments.

- Industry Preference – Software, enterprise software, biotechnology, etc.

- Stage Preference – Seed stage, early stage, later stage and private equity investments.

Carlyle Group

- Industry Preference – healthcare, software, web hosting, etc.

- Stage Preference – Early stage, later stage and private equity investments.

- Industry Preference – healthcare, software, web hosting, etc.

- Stage Preference – Early stage, later stage and private equity investments.

Extream Ventures

- Industry Preference – Software, social network media and enterprises.

- Stage Preference – Seed and early stage investments.

- Industry Preference – Software, social network media and enterprises.

- Stage Preference – Seed and early stage investments.

GGV Capital

- Industry Preference – Consumer products and services, healthcare, internet, networking, telecommunication, etc.

- Stage Preference – Seed stage, early stage, later stage venture investments, private equity and debt financing investments.

- Industry Preference – Consumer products and services, healthcare, internet, networking, telecommunication, etc.

- Stage Preference – Seed stage, early stage, later stage venture investments, private equity and debt financing investments.

Gobi partners

- Industry Preference – Digital media and digital technology.

- Stage Preference – Seed stage, early stage and later stage venture investments.

- Industry Preference – Digital media and digital technology.

- Stage Preference – Seed stage, early stage and later stage venture investments.

Golden Gate Ventures

- Industry Preference – Software, ecommerce, enterprise software.

- Stage Preference – Seed stage and early stage investments.

- Industry Preference – Software, ecommerce, enterprise software.

- Stage Preference – Seed stage and early stage investments.

Innosight Ventures

- Industry Preference – IT, mobile applications, gaming, infrastructure, security and internet marketing and finance.

- Stage Preference – Seed stage and early stage investments.

- Industry Preference – IT, mobile applications, gaming, infrastructure, security and internet marketing and finance.

- Stage Preference – Seed stage and early stage investments.

Intel capital

- Industry Preference – Digital media and entertainment, computing, software services, mobile, consumer internet, etc.

- Stage Preference – early stage and later stage investments.

- Industry Preference – Digital media and entertainment, computing, software services, mobile, consumer internet, etc.

- Stage Preference – early stage and later stage investments.

iGlobe Partners

- Industry Preference – Manufacturing, cloud computing, software.

- Stage Preference – Early stage and later stage investments.

- Industry Preference – Manufacturing, cloud computing, software.

- Stage Preference – Early stage and later stage investments.

JFDI.Asia

- Industry Preference – Mobile and digital media.

- Stage Preference – Seed stage investments.

- Industry Preference – Mobile and digital media.

- Stage Preference – Seed stage investments.

Jungle Ventures

- Industry Preference – Mobile, ecommerce, curated web, etc.

- Stage Preference – Seed stage and early stage investments.

- Industry Preference – Mobile, ecommerce, curated web, etc.

- Stage Preference – Seed stage and early stage investments.

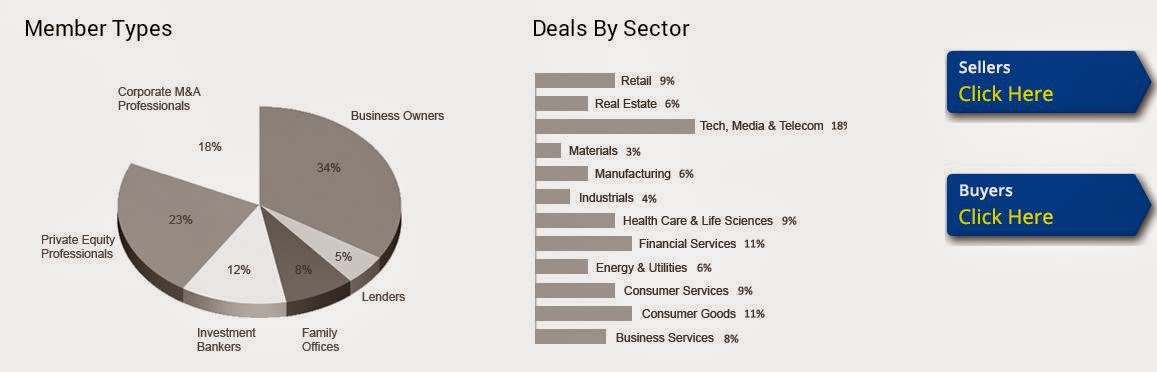

Merger Alpha

Merger Alpha is a Singapore-based M&A platform, an intelligent network,that connects business owners to their strategic and financial buyers and advisors of the startup ecosystem.

Merger Alpha is a Singapore-based M&A platform, an intelligent network,that connects business owners to their strategic and financial buyers and advisors of the startup ecosystem.

TNF Ventures

- Industry Preference – Media, technology, telecommunication, medical and eco-related products and services.

- Stage Preference – Seed stage and early stage investments.

- Industry Preference – Media, technology, telecommunication, medical and eco-related products and services.

- Stage Preference – Seed stage and early stage investments.

Upstream Ventures

- Industry Preference – IT, software, internet, security, biometrics, IDM and semi-conductors.

- Stage Preference – Early stage investments.

- Industry Preference – IT, software, internet, security, biometrics, IDM and semi-conductors.

- Stage Preference – Early stage investments.

Conclusion

With the government of Singapore actively involved in

boosting the startup industry by launching various initiatives to attract

investors, the city-state is emerging as an ideal destination for those looking

for venture capital financing in Singapore. What can further help the entrepreneurs

is an intelligent network that can not only give them easy access to capital

but also reduce the time required to find the right investor.

If you too are planning to raise capital for your

newly-started business, feel free to visit Merger Alpha at http://www.mergeralpha.com/ , the intelligent network

where you can get in touch with your potential investors and financial advisors

without wasting your valuable time.

You can also leave your queries in the comment box given

below.

Good Luck!

No comments:

Post a Comment